Choose country or region to see content specific to your location

View Countries List

View Countries List

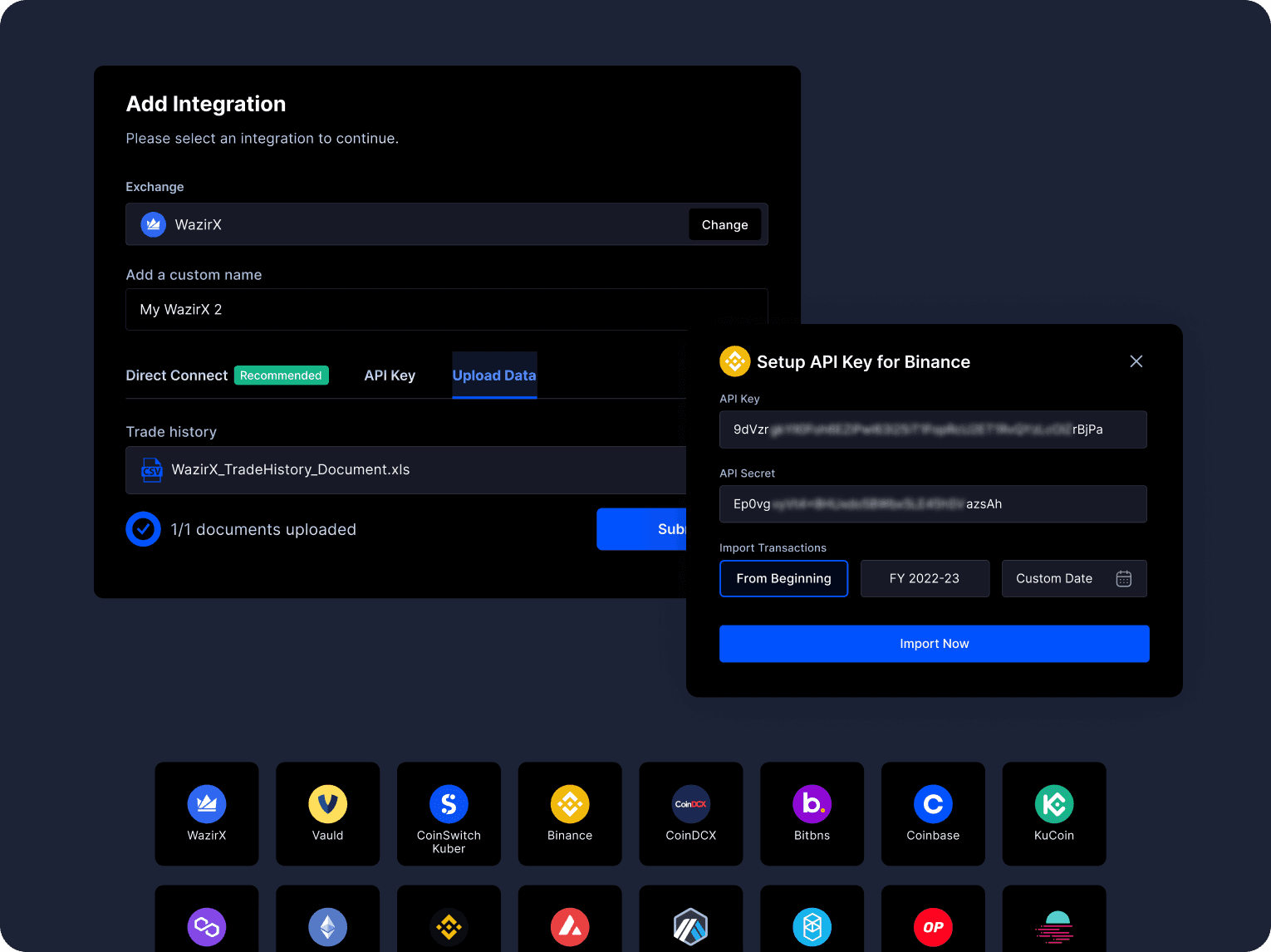

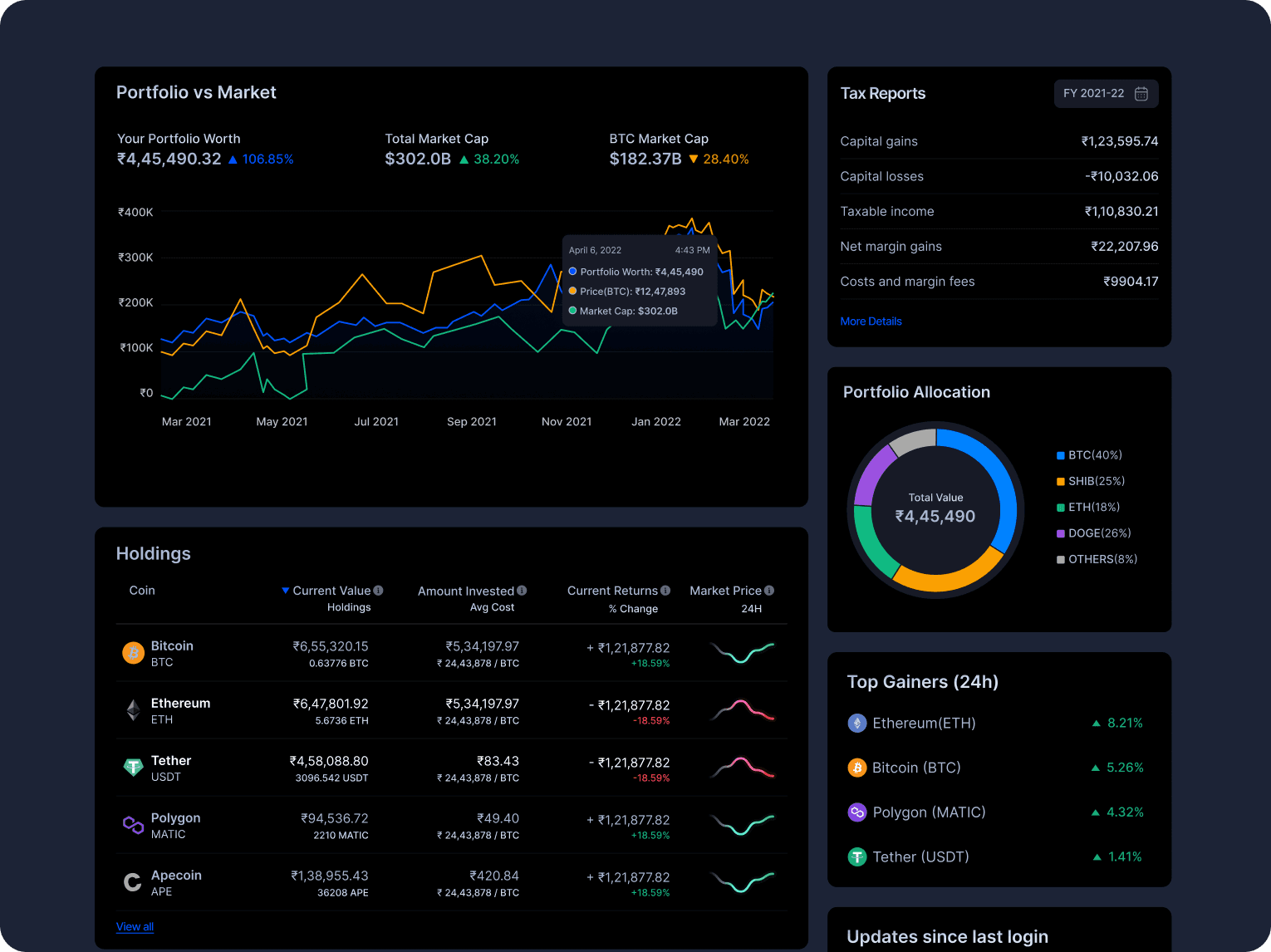

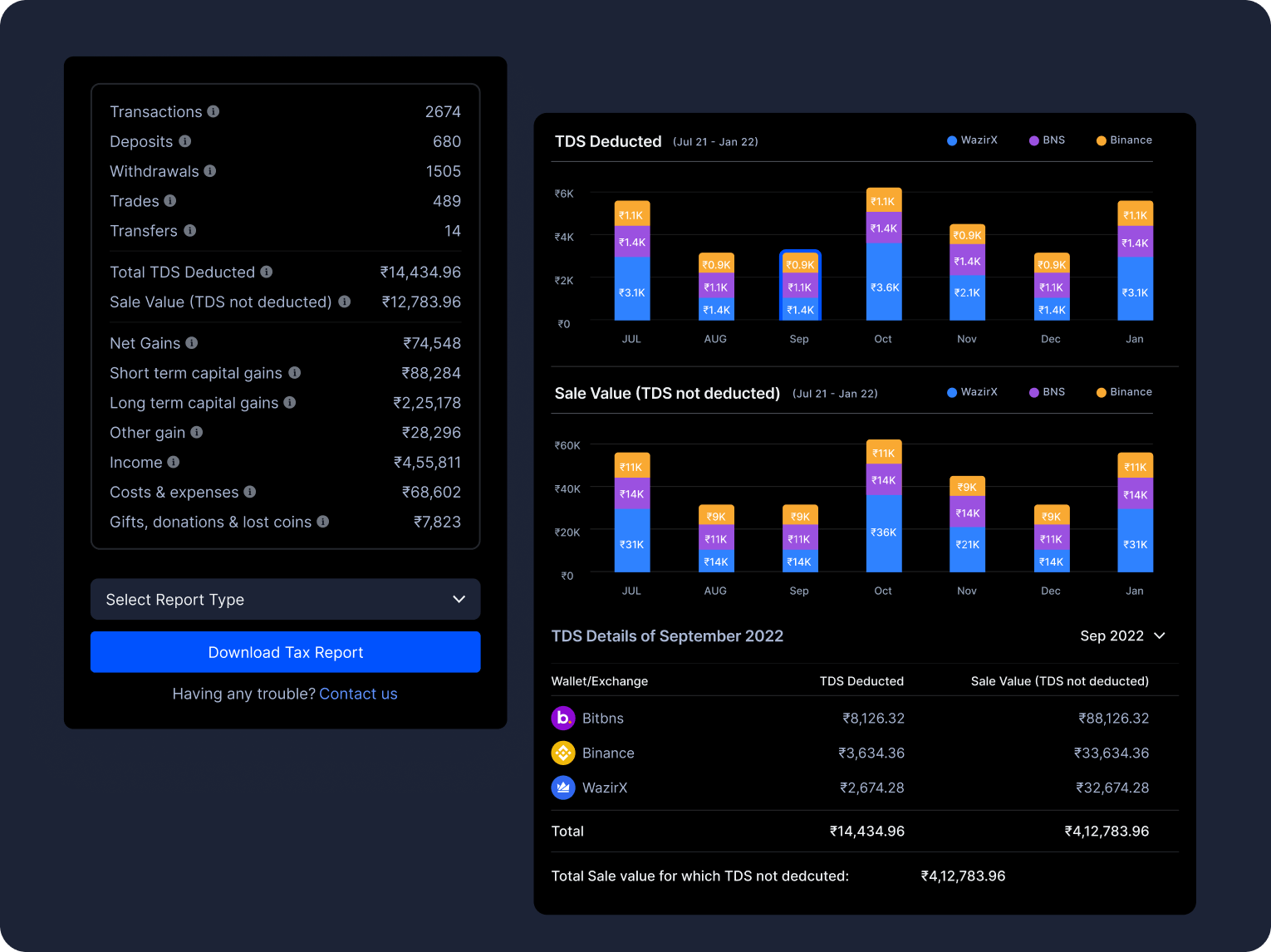

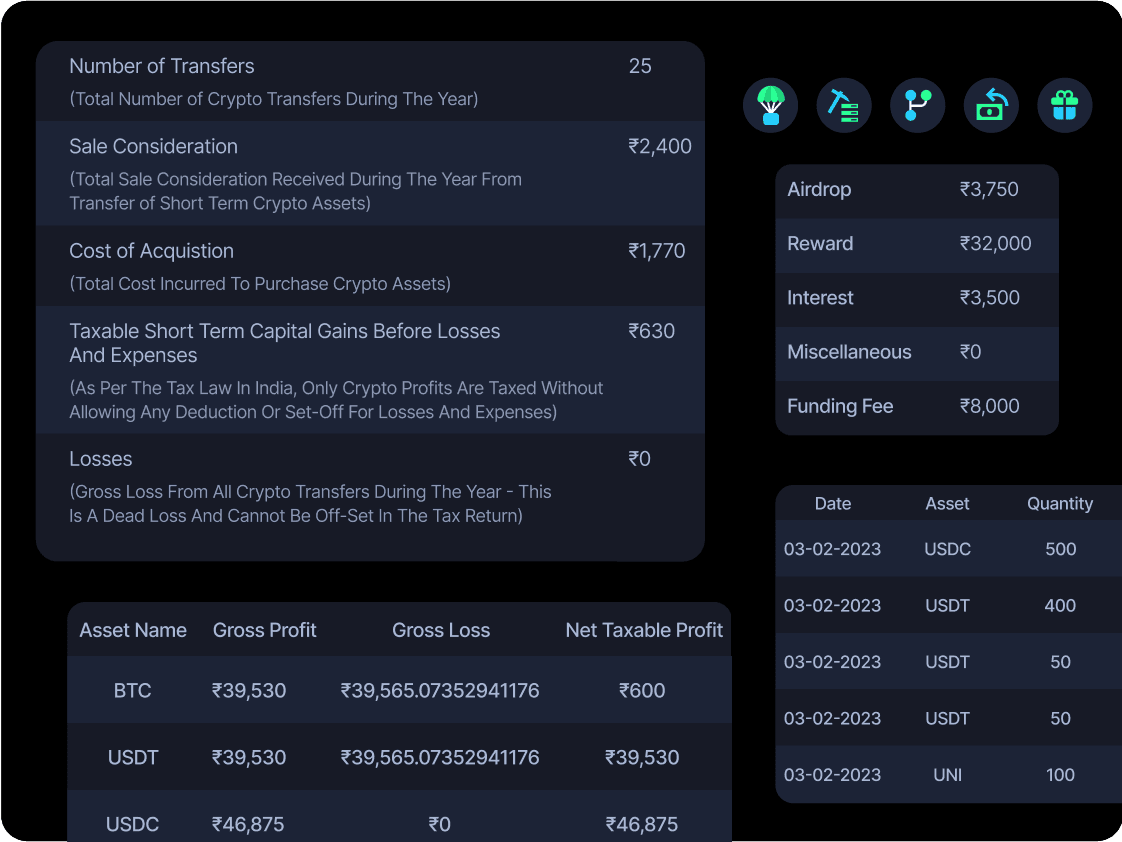

Take control of your cryptocurrency portfolio.

KoinX offers an easy-to-use interface, free tools, and resources to meet all your crypto tax needs.

Simplify the Crypto tax reporting process.

KoinX offers powerful tools tailored to manage your clients' crypto tax reporting needs effortlessly.

Co-Founder - Polygon

Global CEO - CleverTap ex-Chairman, CRO - FreshWorks

Managing Director - Ripple

Partner - iSeed

Global Chief Strategy Officer- OYO

ex-CEO ZebPay