Choose country or region to see content specific to your location

Get Started for FREE

View Countries List

View Countries List

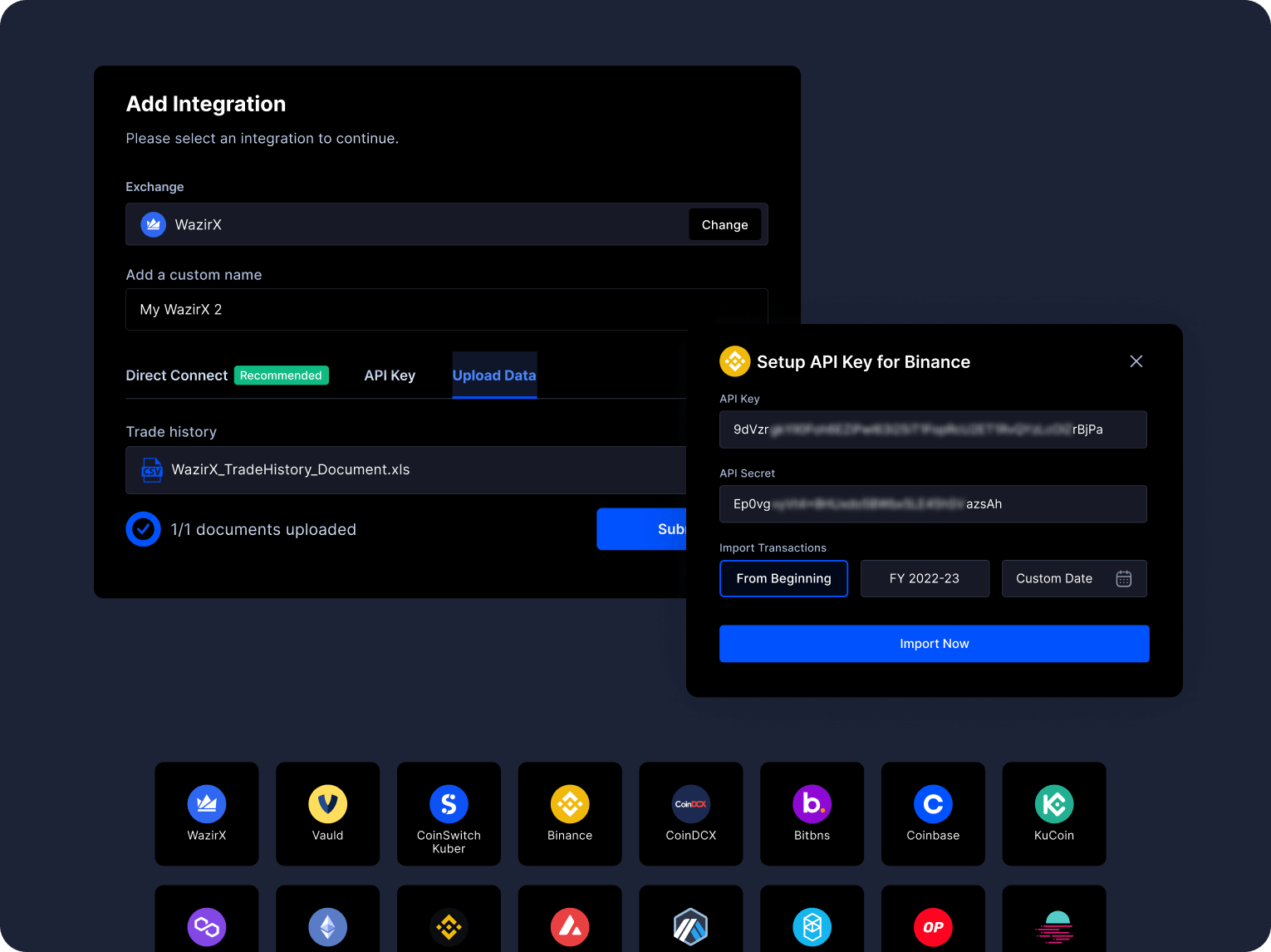

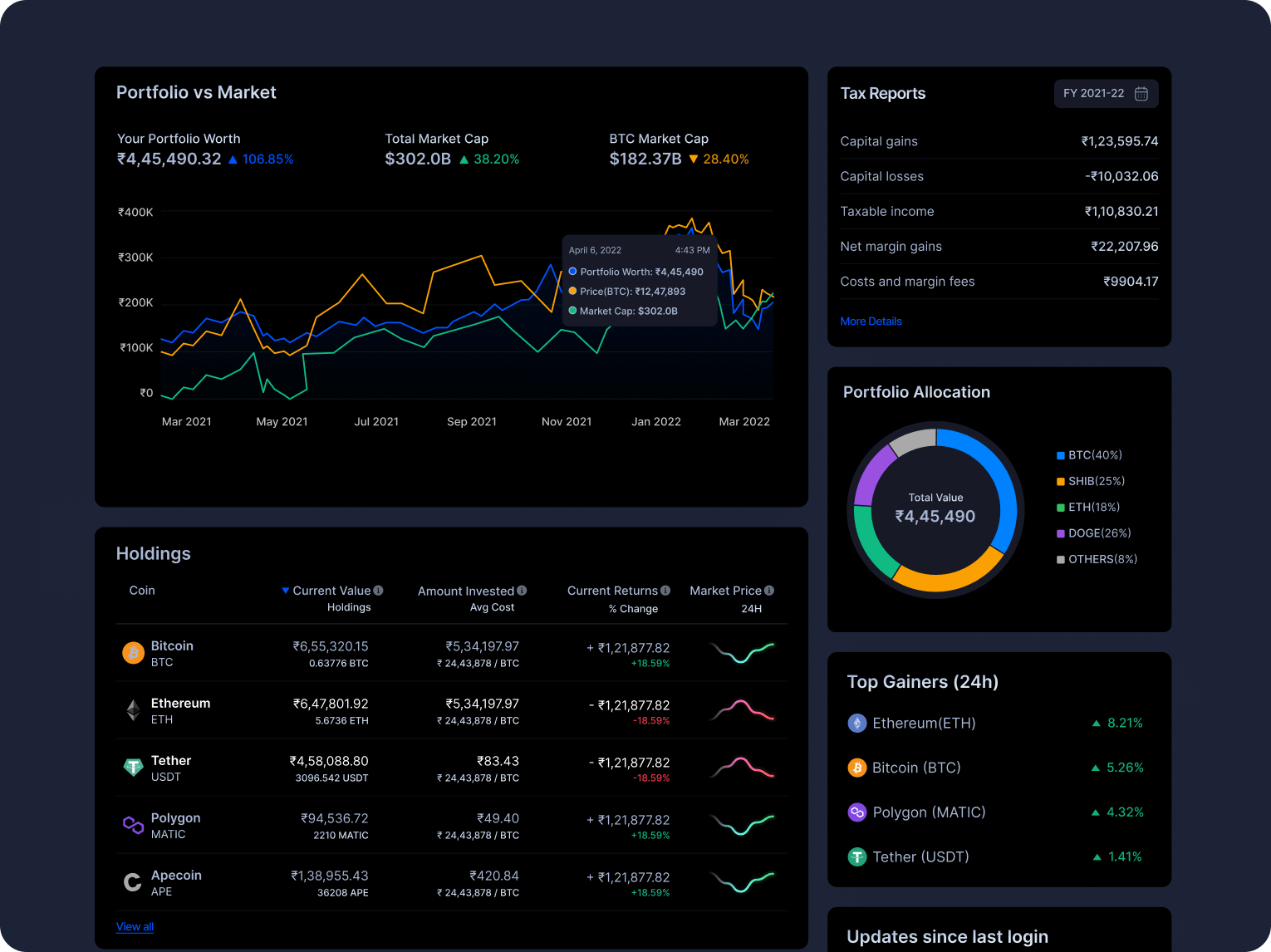

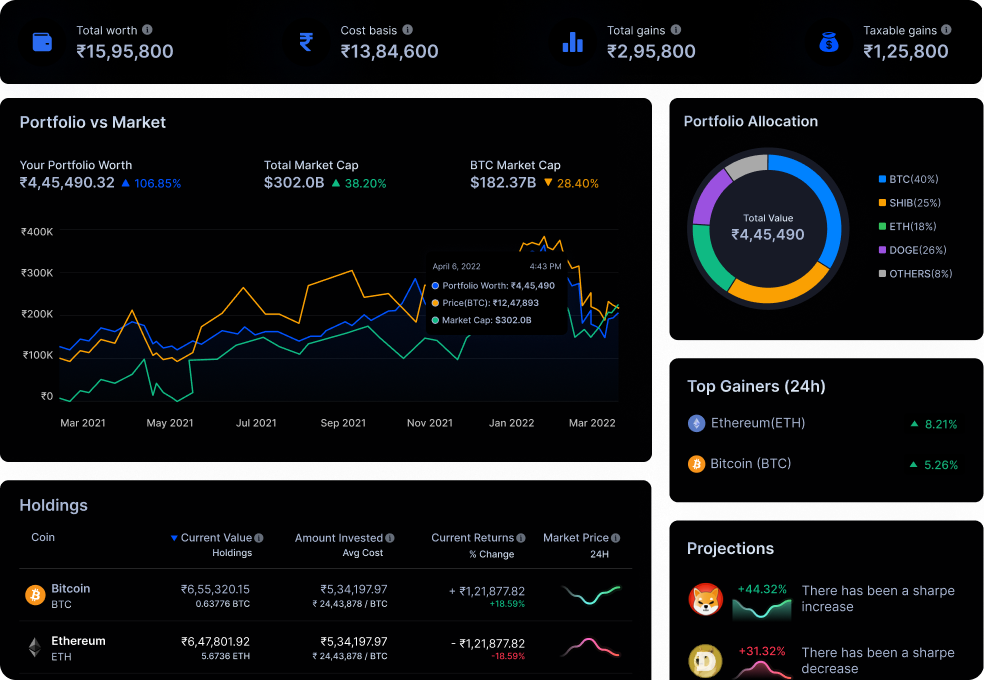

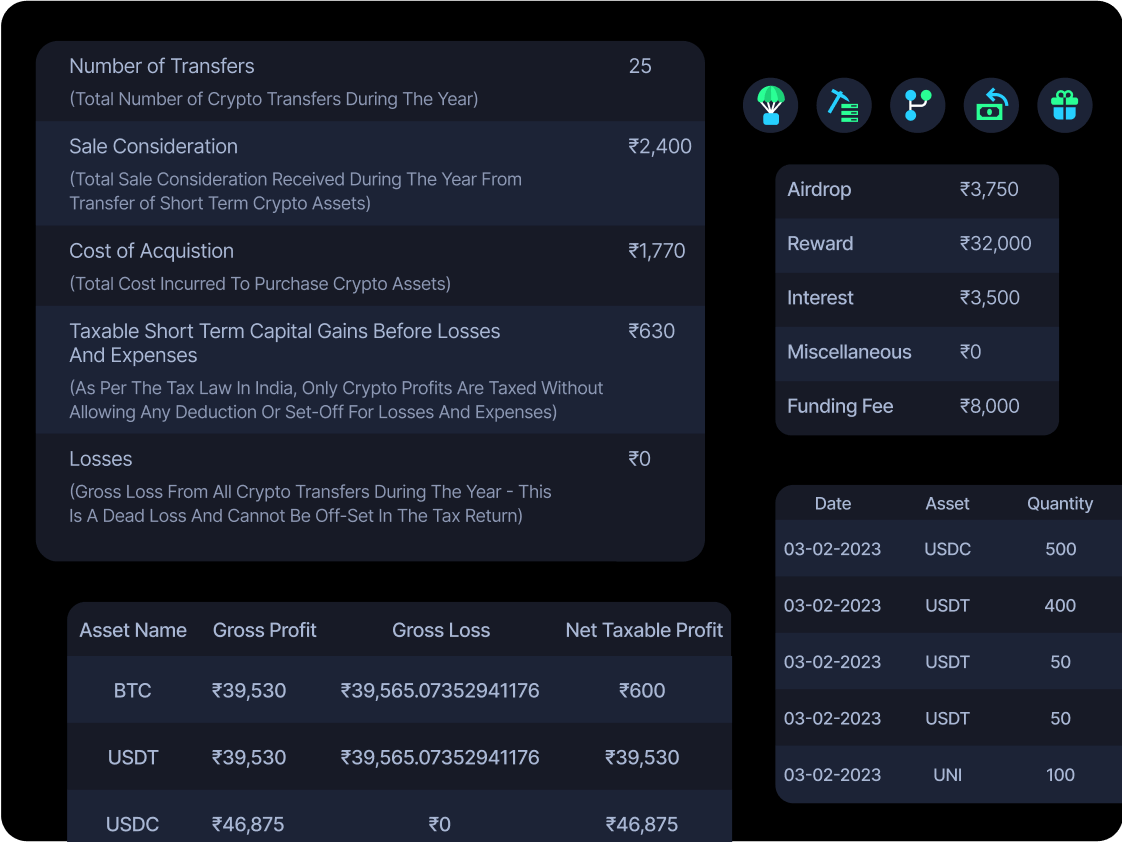

Monitor your crypto portfolio's growth effortlessly. Track holdings from all your wallets and accounts under a unified dashboard.

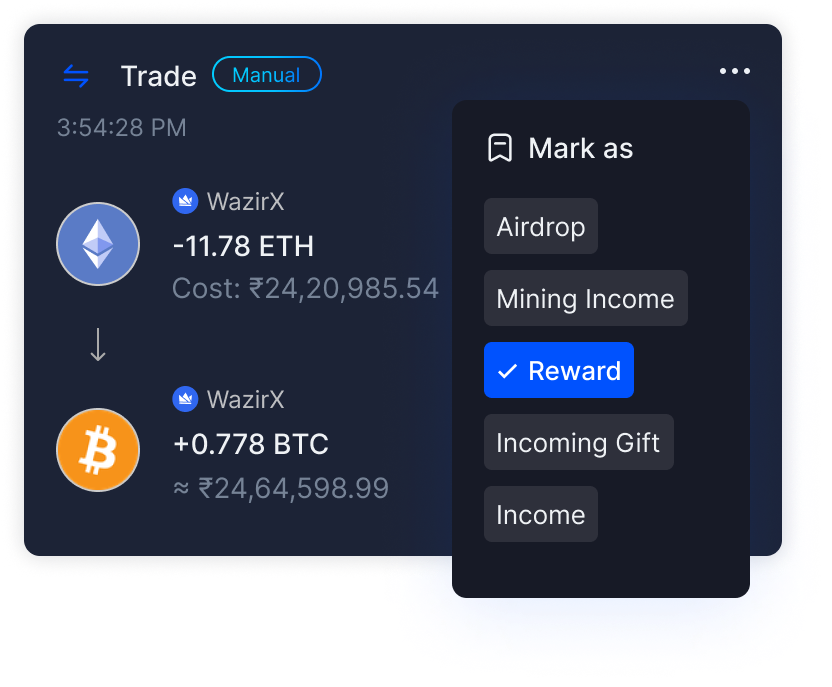

Easily review, categorise and discover missing transactions to ensure data accuracy effortlessly.

KoinX can process lakhs of transaction data in seconds. Streamline data management and make the crypto journey efficient.

Automatically categorise transactions, including staking rewards, payroll expenses, and airdrops, while identifying transaction counterparties.

Take control of your cryptocurrency portfolio.

KoinX offers an easy-to-use interface, free tools, and resources to meet all your crypto tax needs.

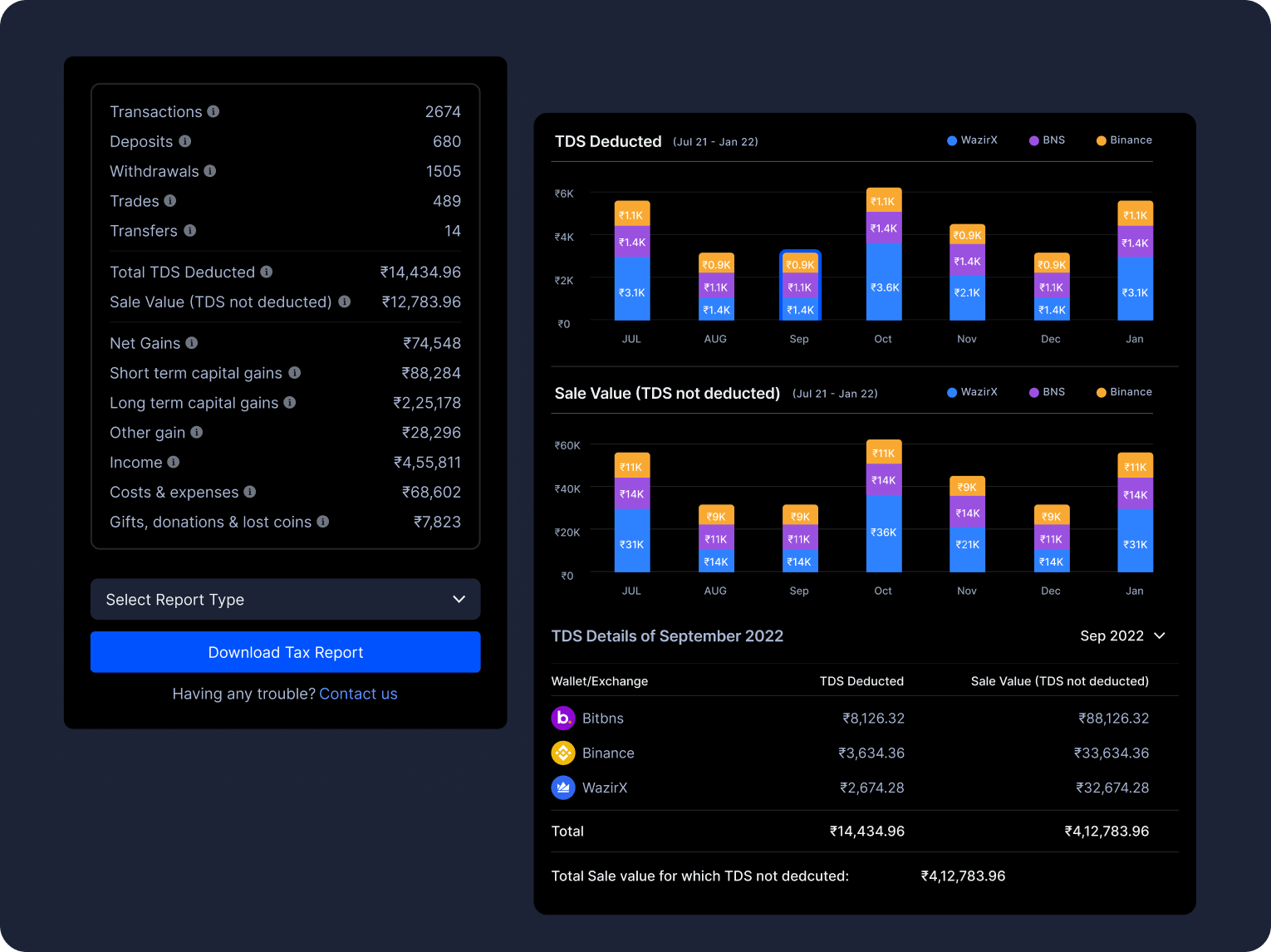

Simplify the Crypto tax reporting process.

KoinX offers powerful tools tailored to manage your clients' crypto tax reporting needs effortlessly.

Co-Founder - Polygon

Global CEO - CleverTap ex-Chairman, CRO - FreshWorks

Managing Director - Ripple

Partner - iSeed

Global Chief Strategy Officer- OYO

ex-CEO ZebPay