Understanding KoinX Books Overview for Crypto Accounting

KoinX Books is a user-friendly crypto accounting and bookkeeping platform designed to simplify, accurately, and stress-free management of digital assets. Whether you're an individual investor, trader, or finance team member, KoinX Books gives you complete control and clarity over your crypto transactions, all from a single intuitive dashboard.

Built to eliminate the confusion around crypto bookkeeping, KoinX Books helps you categorize transactions, automate accounting workflows, and generate tax-ready reports without needing to be an accounting expert.

Modules & Key Functions

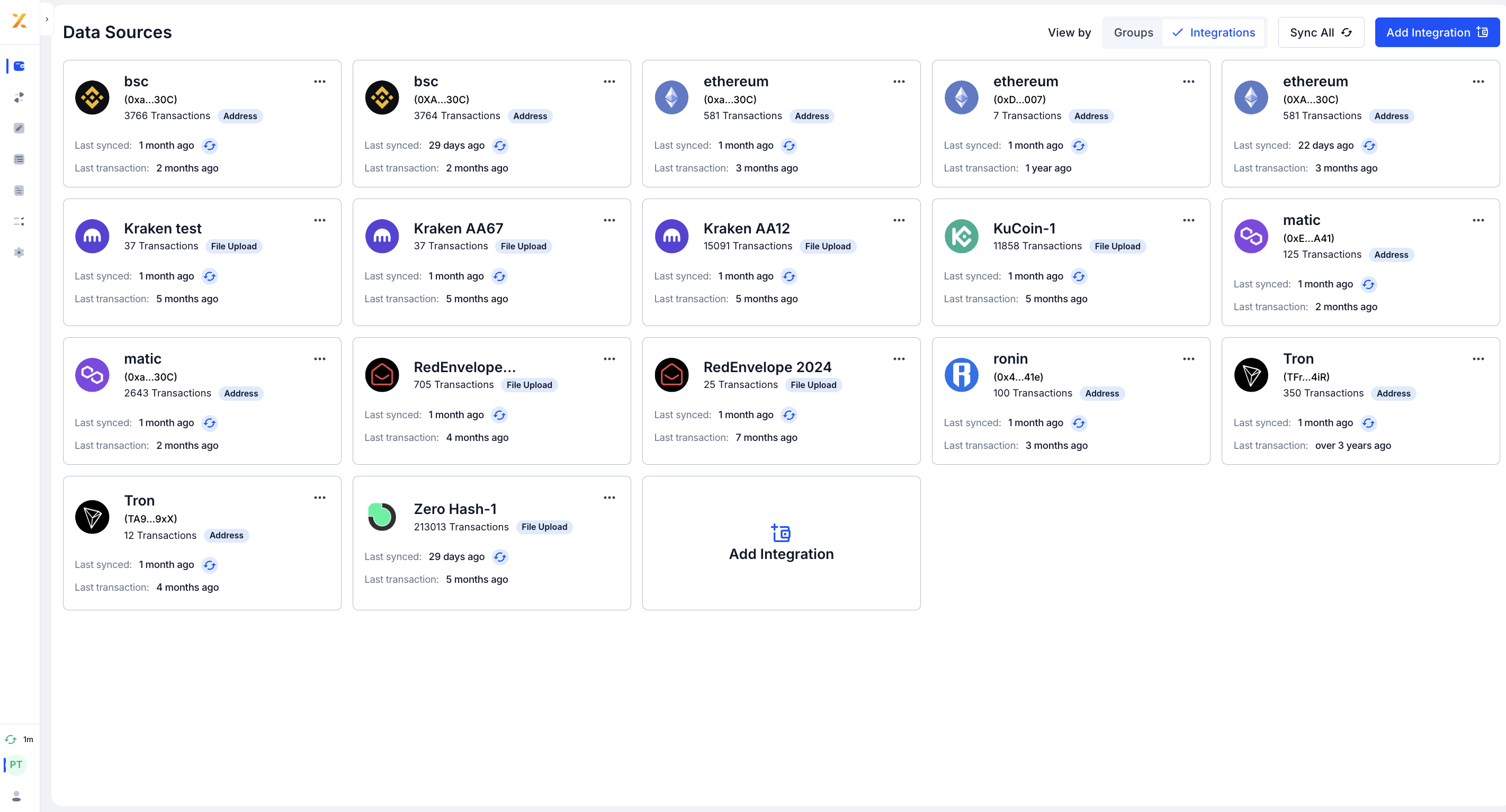

Data Sources

Connect and sync your crypto data automatically.

- Link wallets, exchanges, and public blockchain addresses

- Auto-syncs historical and real-time transaction data

- Supports major crypto platforms for seamless integration

- Name your wallets and integrations for easy internal reference

Use case: Automates data collection to eliminate manual imports and ensure all transactions are captured accurately.

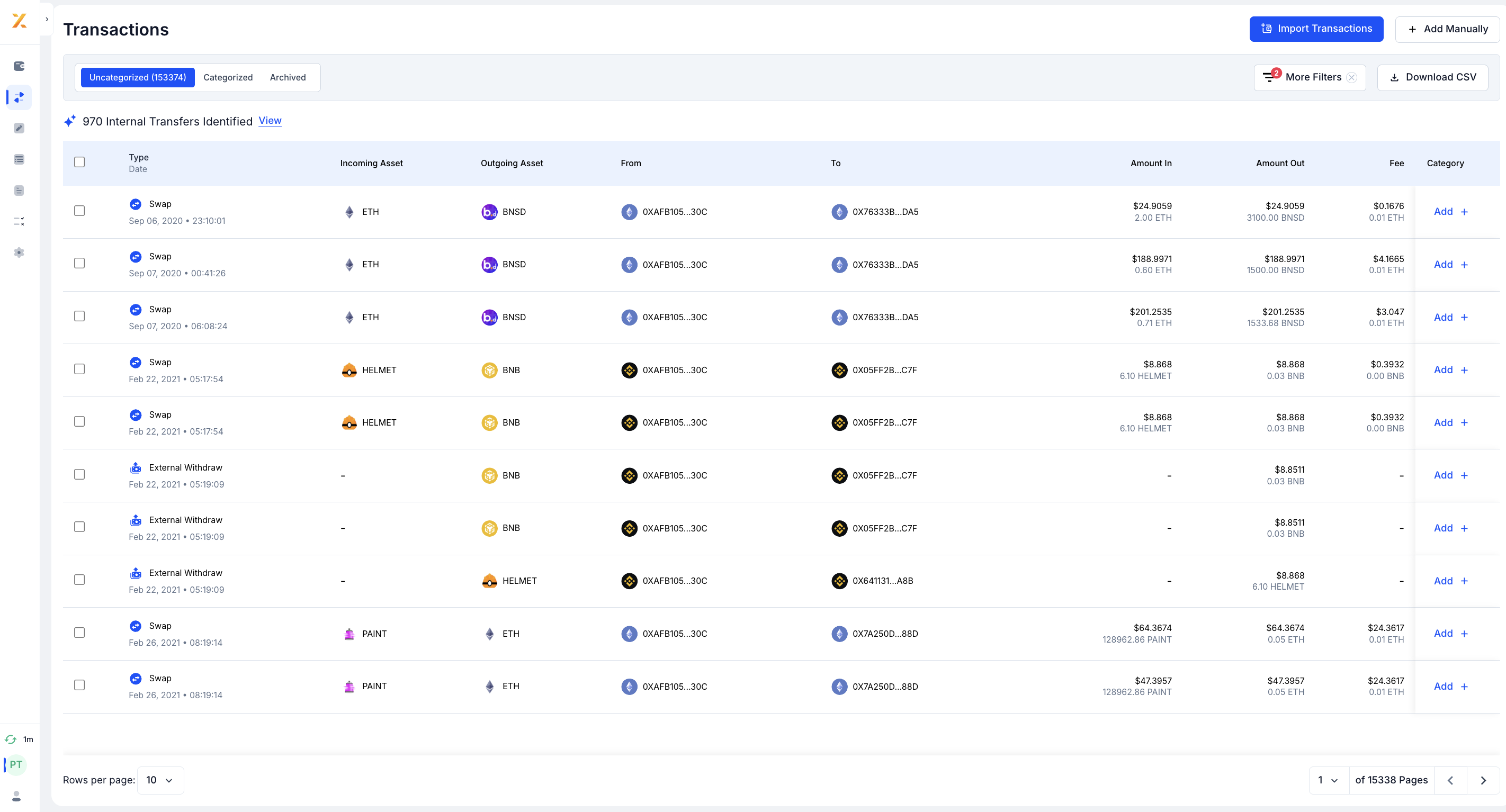

Transactions

View and manage every crypto transaction.

- Displays a consolidated view of all incoming and outgoing activities

- Detects and flags internal transfers

- Allows manual or bulk categorization of transactions

- Filter transactions by type, date, or other criteria

- Add transactions manually when needed

- Download complete or filtered transaction data

Use case: Keeps your transaction history organized and ready for categorization, helping you maintain accurate financial records.

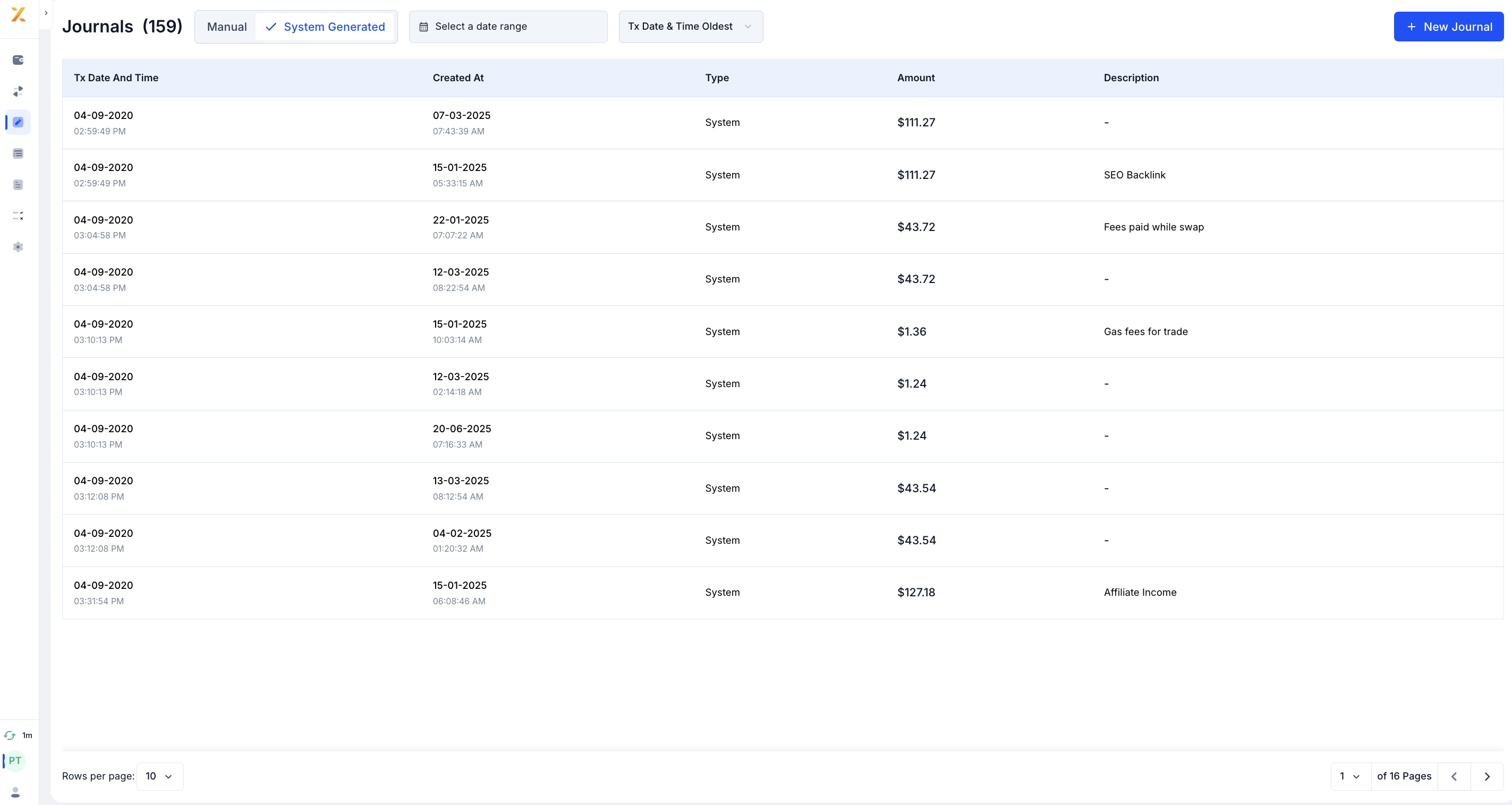

Journals

Generate structured accounting entries automatically.

- Stay compliant by tracking all journal entries

- Manually add journal entries when needed

- Adheres to standard accounting principles for ledgers and reconciliation

- Monitor system-generated journal entries for accuracy

Use case: Accurately reflects every crypto transaction in your books, reducing the need for manual adjustments.

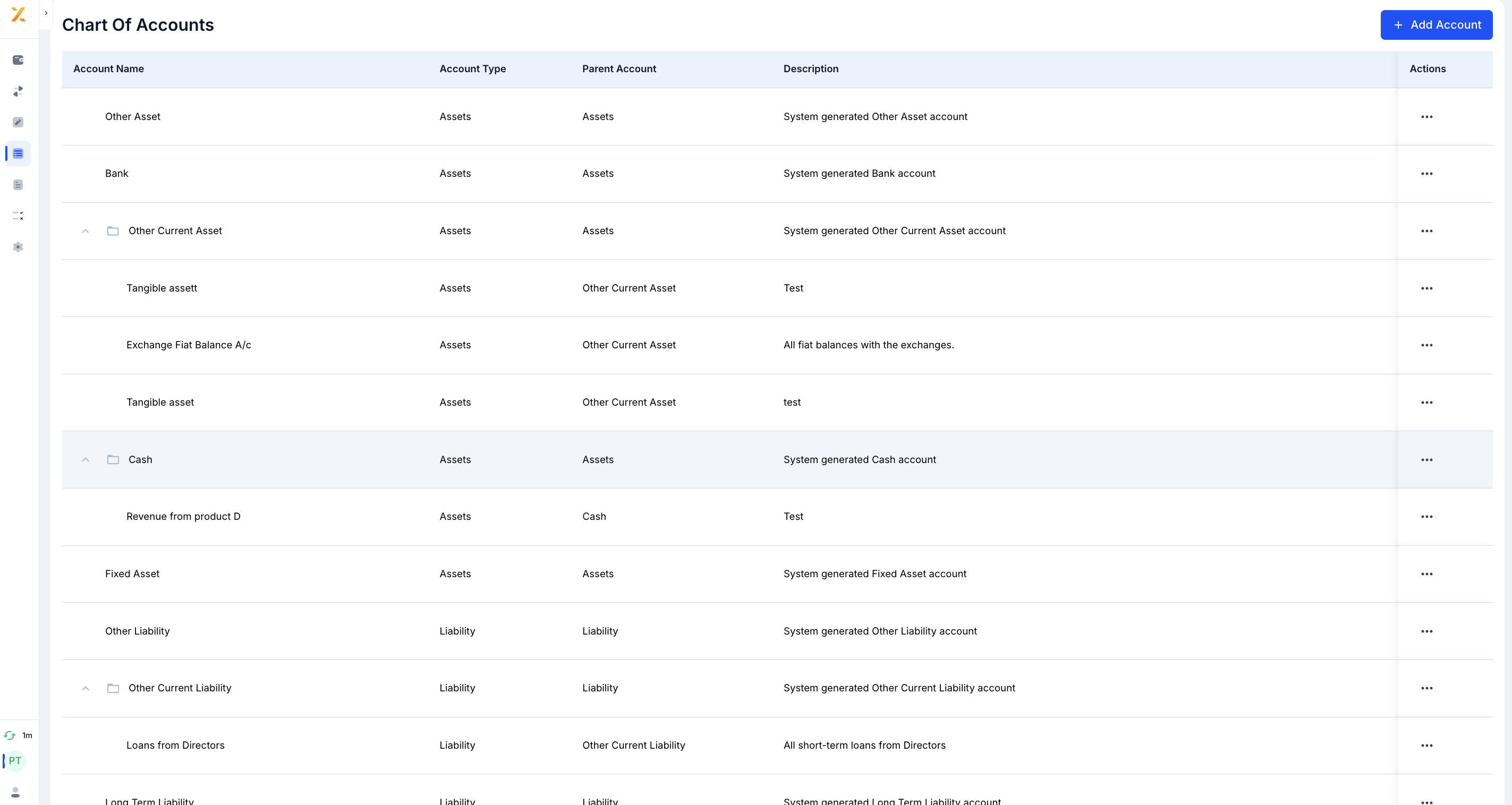

Chart of Accounts

Customize how your cryptocurrency activity is mapped to your books.

- Create and manage your chart of accounts

- Categorize assets, liabilities, income, and expenses

- Aligns with your internal or statutory financial structure

Use case: Tailors the bookkeeping setup to match your business's financial framework.

Reports

Generate audit-ready and tax-compliant reports.

- Provides Profit & Loss statements, Capital Gains summaries, and portfolio breakdowns

- Exportable in CSV and other formats for tax filing and audits

- Offers real-time insights into financial performance

Use case: Enables quick reporting for compliance, internal reviews, or external audits.

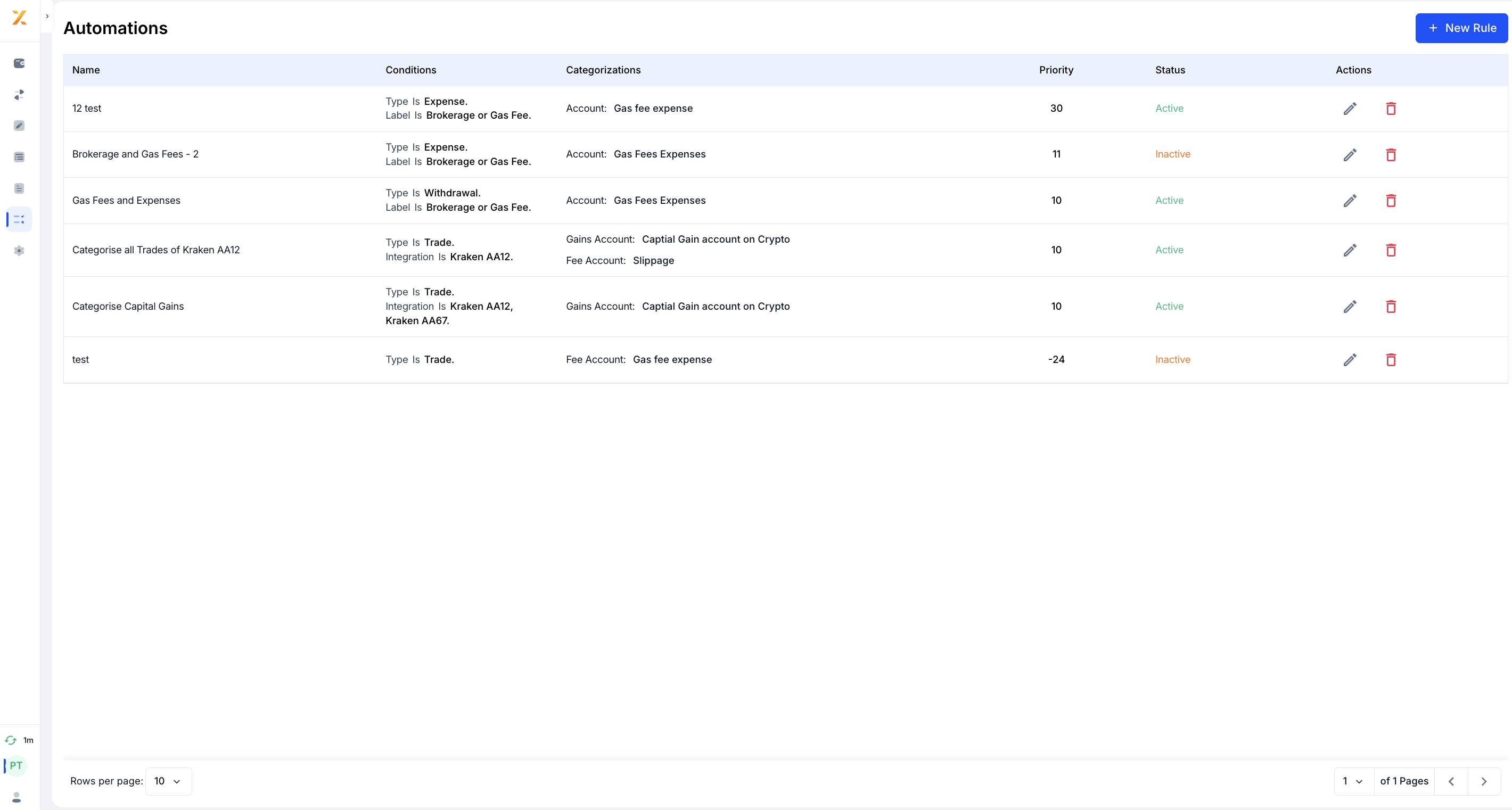

Automation

Speed up categorization with smart rules.

- Set rules based on token, wallet address, or transaction type

- Automatically tags and classifies transactions

- Reduces manual workload and ensures consistency

Use case: Ideal for large datasets or recurring patterns—saves time and increases accuracy.

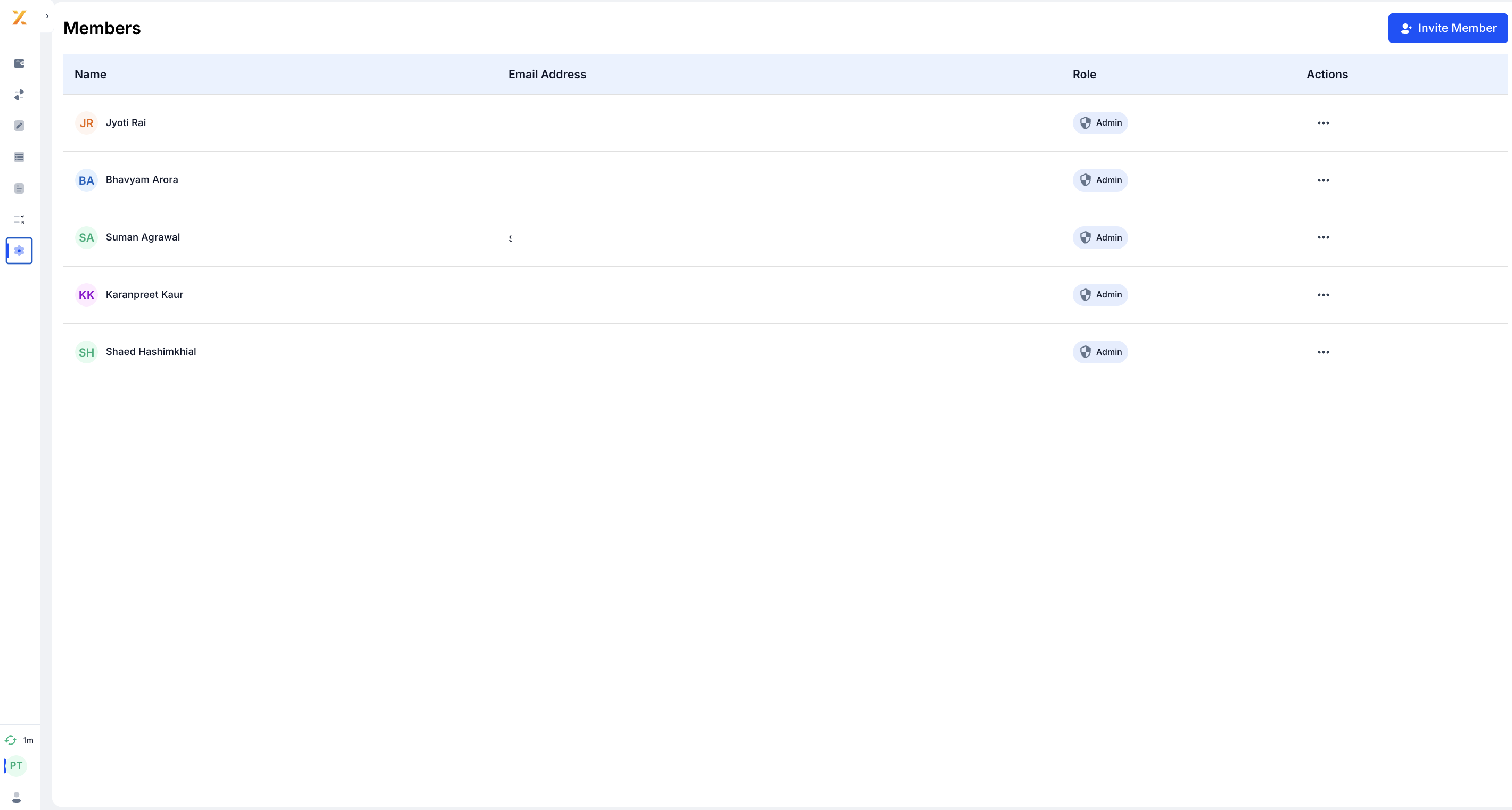

Settings

Customize the platform to your workflow.

- Define base currency, fiscal year, and timezone

- Manage user access and team permissions

- Control integrations and data sync preferences

Use case: Provides flexibility to match operational, regional, and organizational requirements.